VAT

Efficient & Compliant VAT Registration UK Services

Simplifying VAT for Your Business

VAT (Value Added Tax) is a crucial part of running a business in the UK, and staying compliant with HMRC regulations is vital to avoid costly penalties. At Strix Accountancy, we specialise in VAT registration UK, offering expert VAT services tailored to your business needs, making compliance simple, accurate, and stress-free.

Our team of qualified professionals supports you with VAT registration UK, filing VAT returns, and managing complex VAT schemes. Whether you’re launching a new business or scaling up, we ensure your VAT processes are managed efficiently so you can focus on growth.

ICAEW Chartered | VAT Registration UK Experts at Your Service

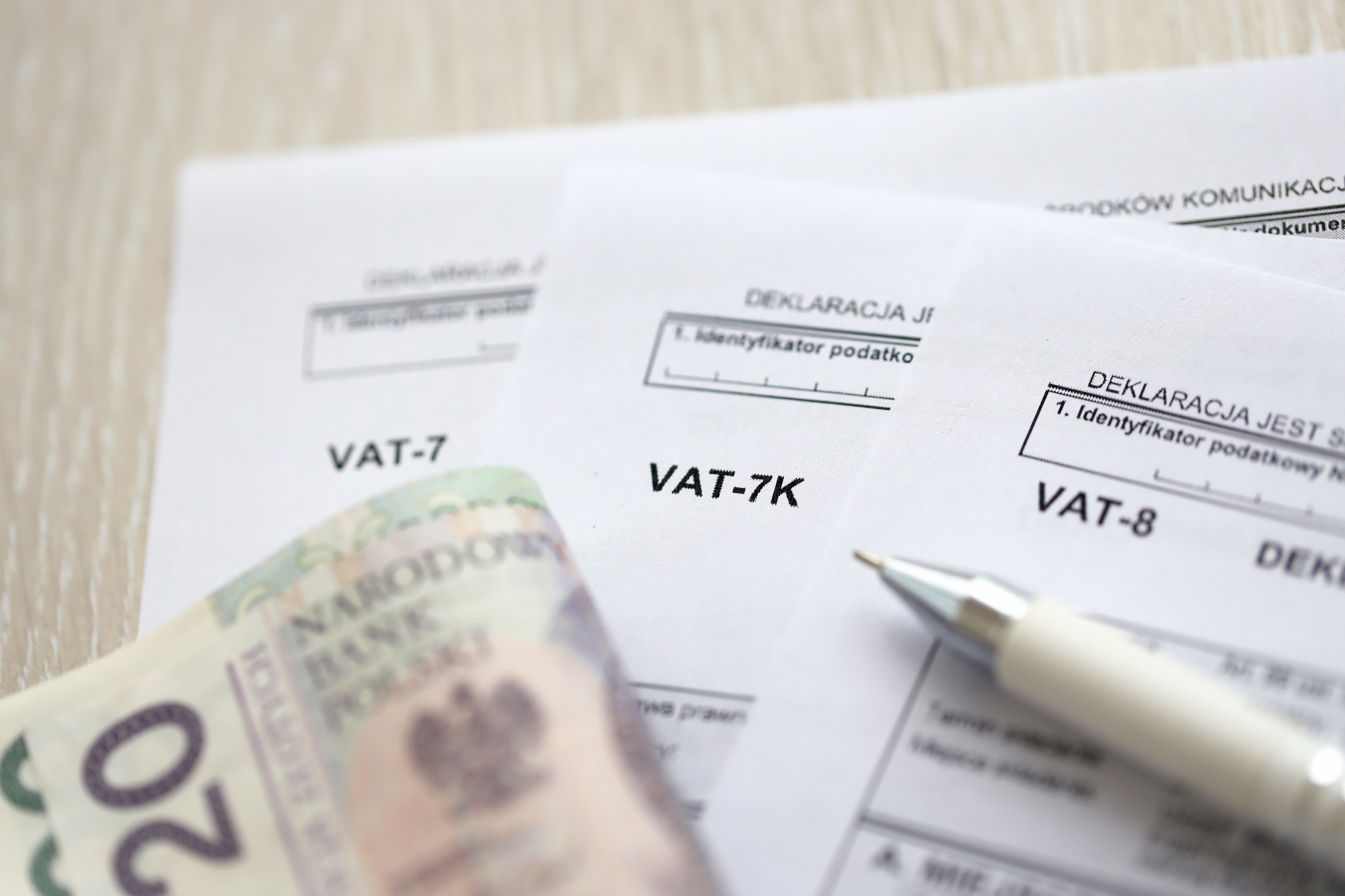

What is VAT & Why VAT Registration UK Matters

VAT is a tax on the sale of goods and services that businesses charge their customers. In the UK, most businesses with a taxable turnover above the VAT threshold must register for VAT and submit quarterly or annual VAT returns to HMRC.

Failure to manage VAT properly can result in penalties, interest charges, and tax audits, which can disrupt your business operations and lead to unexpected costs. Keeping your VAT records accurate is also essential for maintaining cash flow and avoiding overpayments.

Outsourcing your VAT responsibilities to Strix Accountancy ensures that your returns are correct, timely, and compliant with the latest legislation, saving you time, money, and stress.

Our VAT Services – What’s Included?

VAT Registration We assist with VAT registration for your business, ensuring it’s done correctly and promptly.

VAT Returns Filing We prepare and file your VAT returns on time, ensuring compliance with HMRC and avoiding penalties.

VAT Advice & Guidance We provide expert advice on VAT rates, exemptions, and schemes that best suit your business.

HMRC Correspondence We handle all HMRC communications, ensuring that your VAT-related queries are resolved quickly.

VAT Audits & Reviews We conduct regular VAT reviews and audits to ensure accurate reporting and catch any potential issues before they arise.

With Strix Accountancy’s VAT services, you’re guaranteed peace of mind knowing your VAT processes are in expert hands.

The Benefits of Outsourcing VAT to Strix Accountancy

Save Time & Focus on Business Growth

We handle all VAT-related tasks, so you don’t have to worry about deadlines or calculations.

Ensure Full Compliance

Our team ensures that your business remains fully compliant with HMRC’s ever-evolving VAT regulations.

Accurate VAT Returns

No more stress over VAT errors—our team ensures accurate calculations and timely submissions.

Expert Advice

We help you understand VAT rates, exemptions, and schemes to optimise your VAT costs.

Avoid Penalties

We ensure your returns are submitted on time to avoid fines and late payment charges.

The Benefits of Outsourcing VAT to Strix Accountancy

Save Time & Focus on Business Growth – We handle all VAT-related tasks, so you don’t have to worry about deadlines or calculations.

Ensure Full Compliance – Our team ensures that your business remains fully compliant with HMRC’s ever-evolving VAT regulations.

Accurate VAT Returns – No more stress over VAT errors—our team ensures accurate calculations and timely submissions.

Expert Advice – We help you understand VAT rates, exemptions, and schemes to optimise your VAT costs.

Avoid Penalties – We ensure your returns are submitted on time to avoid fines and late payment charges.

Precision. Clarity. Confidence.

Here’s how it works…

Manage invoicing, expenses, and payments — all in one place via your client portal.

We handle all your bookkeeping, payroll processing, bank reconciliations, and VAT management hassle-free

Each month, one of our accountancy team members will provide you with your financial reports and expert guidance.

At the end of the year, we’ll organise your returns and file them with Companies House and/or HMRC on your behalf.

FAQs – VAT Services

What is VAT registration?

VAT registration is the process of registering your business with HMRC for VAT if your taxable turnover exceeds the registration threshold.

How often do I need to file VAT returns?

Most businesses file VAT returns quarterly. However, some businesses may qualify for annual VAT returns or other schemes.

Can Strix Accountancy help with VAT audits?

Yes! We can help you prepare for and manage VAT audits, ensuring your records are always accurate and compliant.

How can you help with international VAT?

We offer expert advice and assistance with EU VAT compliance, import/export VAT, and VAT for digital services..